The Bitcoin Energy Debate

As usual, when the price of Bitcoin goes up, the doomsday headlines about its energy usage start re-emerging from the usual suspects. The last time price had a downturn, even as mining hashrate was still increasing, the same crowd was mostly silent on this issue. Since we've gotten this question many times recently, we figured we would help frame the argument from countless hours of research on this topic over the years.

To start, this is an extremely complex topic and unfortunately most of those joining the anti-Bitcoin mob here, claiming it is simply "boiling the ocean" and "wasting energy," routinely leave out crucial context that would help others gain perspective. It's important to first define this context but also get to the heart of the issue. Pointing out comparables, double standards, and hypocrisy can assist in laying out the context for people but it needs to be followed by answering more foundational questions. Namely, does the utility of a sovereign, non-state controlled asset like Bitcoin justify its energy consumption?

We'll get to this but first, let's do the context part.

It's easy for anyone to jump on the bandwagon of criticizing Bitcoin's energy usage without looking into the broader arguments around its utility and type of energy usage, along with the variety of comparable data points. Whenever Bitcoin's price goes up, the public is inundated with biased articles churned out weekly from mainstream "tech journalists," the New York Times, and peers. Keep in mind, these are the same establishment, old guard institutions cheering for Bitcoin to fail and have claimed its demise publicly hundreds of times over the years. Anyone deeply involved in this industry consistently witnesses just how poorly the majority of mainstream sources cover this space.

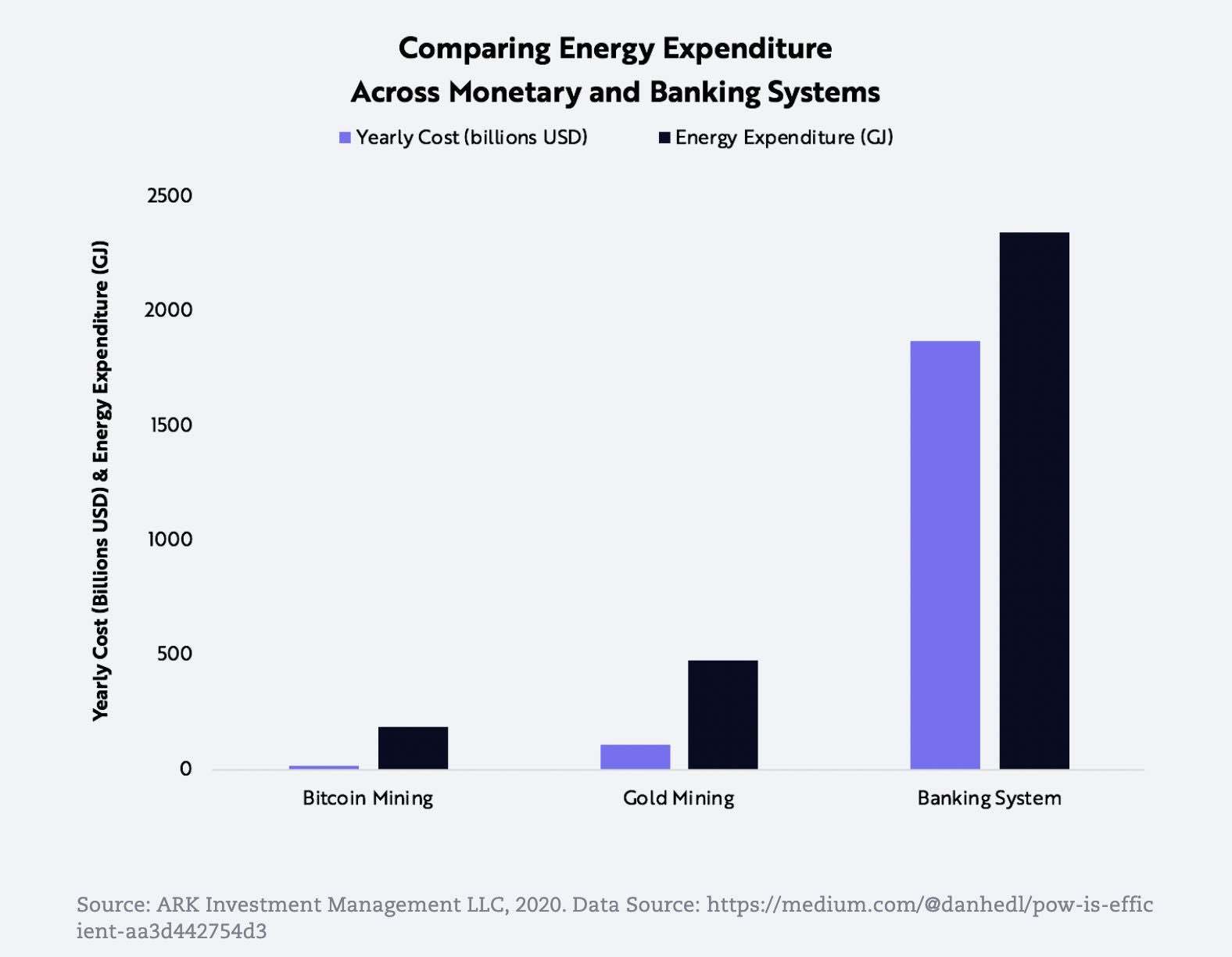

What you find in much of the "analysis" is always basic, unrelated comparisons such as "Bitcoin uses as much energy as American Airlines!" or some assumed hashrate data extrapolation far into the future that often completely misunderstands the mining protocol's function and conveniently ignores many variables. Or perhaps trying to compare Bitcoin to Visa, as if they are at all the same technology or use-case (although as the Lightning Network grows for payment channels, perhaps then we can compare that to Visa directly). Bitcoin is more than a payments network, it's more akin to Fedwire but for anyone's individual digital bank, with monetary policy and issuance attached. The primary use of Bitcoin's energy is to protect and encrypt over $1 trillion in digital assets in cyberspace (as of writing this), not just to process transactions. The critics of Bitcoin consistently misunderstand this.

It's effortless and simplistic to point to Bitcoin's kWh and compare it to "X Activity or Thing" and come across as an intellectual analyst to many – yet it's intellectually dishonest. The usual suspects never get to the heart of why Bitcoin needs to use this energy approach to secure the network, what that utility means in practice and for the future, and why people around the world, particularly in third world countries, already derive major value (sometimes lifesaving) from the network under dictatorships, communism, and in times of turmoil.

The same critics always conveniently ignore the large amount of renewable energy used to mine Bitcoin, along with Proof of Work's efficiency in maximizing stranded energy sources and not wasting energy like many other industries – but we'll get to this.

Opponents rarely grapple with the fact that the majority of technology infrastructure and many other things we take for granted, are built upon heavy fossil fuel usage with emissions that dwarf Bitcoin's. The large energy output required to secure the Bitcoin network is a key feature and it is part of what makes Bitcoin's encryption so valuable. It's also important to point out that the reason we can critique Bitcoin's energy consumption granularly is because it's a highly transparent system – and that's in part why it's so powerful. People want radical transparency in an era of distrust in opaque governments and central banks.

If we had the same level of transparency that could track the energy consumption across every industry in real-time, for example data centers that power things like Gaming, Streaming, and Porn (the latter estimated to produce as much CO2 as Belgium but likely much more) or perhaps things like Gold Mining, the Petrodollar or even Christmas lights for example, we would be able to more granularly analyze their energy usage and make the same subjective judgments and questionable extrapolations into the future.

Where's the outrage when it comes to endless comparables regarding emissions? Would Bitcoin opponents carry out the same moral crusade and target other technologies if they knew how much more energy they use than Bitcoin (and often with more waste)? Doubtful. Alarmists typically cherry-pick data – in this case, what humanity should use energy for based on their own opinions and emotions (and mostly because the asset happens to be going up a lot right now – and perhaps some of them also missed out). When it comes to technology, growth, and humanity's energy usage, many are incapable of being rational optimists and instead choose to be irrational pessimists calling for doomsday scenarios.

Even if we hypothetically had transparent energy usage data for other industries and activities, the same critics would likely justify their use of all other technologies and creature comforts to death while continuing their rally against Bitcoin.

Human progress relies on increased energy consumption. Despite its demonization, humanity is largely where it is today because of the portable, dense, highly reliable energy derived from fossil fuel usage that has pulled billions out of poverty and increased life expectancy. Many alarmists will simply not acknowledge this part of the story arc of human progress because it's unpopular. However, now the arc is reaching a point where it's certainly reasonable to diversify and utilize other innovative energy sources such as Gen-4 nuclear and renewables where it makes sense – and most importantly not diminishing the current standards of living in parallel. To undermine this reality and go on to only pick on Bitcoin's energy usage versus other technology is simply shortsighted, ahistorical, and hypocritical.

Bitcoin is already a major part of the broader human progress and ingenuity story.

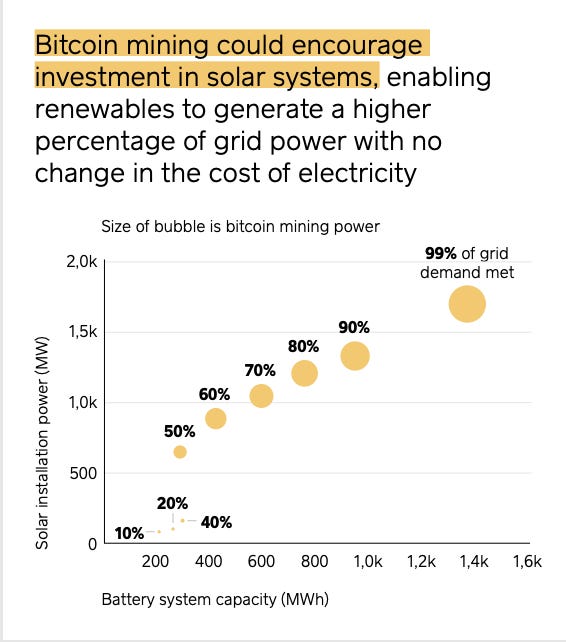

As mentioned, Bitcoin mining's renewable energy usage is rarely talked about by its critics, nor the fact that it's innovating in this area due to the pristine, capitalist incentives and game theory that encourages it. Approximately 76% of Bitcoin mining used renewable energy as part of its energy mix in 2020. More importantly, this mix has continued to go up year over year.

Aside from the known large hydroelectric mining operations, natural gas flare capture is another area to look at closely. Natural gas companies are now increasingly realizing they can mine Bitcoin using flared methane that is otherwise wasted and put into the atmosphere. Methane is a far more impactful greenhouse gas, so Bitcoin would be removing substantial amounts from emissions if this method were adopted at scale (and it's certainly a growing initiative). It allows these companies to both generate revenue and reduce waste and emissions. Positive sum arrangements like this do exist and these are the kinds of variables rarely talked about in the mainstream.

"We believe that cryptocurrency will eventually be powered completely by clean power, eliminating its carbon footprint and driving adoption of renewables globally" ~Jack Dorsey, CEO of Square/Twitter

Unfortunately, regardless of all this context, opponents don't seem to factor it into their arguments. The common sense, non-ideological opponent will understand the energy debate does need to be put into perspective. However, the loud alarmists tend to double-down and avoid addressing these factors altogether. This may be because the value proposition of Bitcoin was never sufficiently communicated to them or more likely, it simply does not resonate with their ideology and subjective worldview (generally bigger government and more central planning). Hence, while the concerns can be legitimate, the arguments are often not in good faith.

This leads us to the most important part of the argument. Once all the context is addressed, we must conclude with a more foundational, philosophical question: Is Bitcoin's energy usage justified for humanity's sake?

After many years of due diligence in this area and accounting for macroeconomic trends and the growth of populism around the world, we believe it's a clear Yes. There is an excellent argument to be made for a sovereign, non-state controlled financial asset that anyone with an internet connection can access. In this use-case, the level of security and decentralization required for the network to be antifragile is only achievable through Proof of Work hardware mining.

"The costliness to produce Bitcoin is fundamental to its value and unlike the US dollar, Bitcoin cannot be printed with the stroke of a keyboard. Instead, it converts the output from cheap stranded energy sources into something with monetary value." ~Yassine Elmandjra, ARK Invest

It's also a broader discussion about liberty, civil rights, and privacy. Many are losing trust in centralized institutions and desire alternatives. In the past, gold has fulfilled some of these needs but in the digital, hyper-connected era, something new is needed that is programmed to be trustless, scarce, decentralized, and unlike gold, highly transportable.

The deeper value of Bitcoin's use-case has been seen in third world countries where currency devaluation or collapse occurred. Bitcoin becomes a way to opt-out of those broken systems, often under authoritarian regimes, and it enables individuals, families, and groups to preserve their wealth through hard times. Most Western critics neglect to mention that Nigeria and South East Asia dominated crypto adoption in 2020, while ignoring success stories in countries that underwent hyperinflation. We tend to live in a bubble here in the West. The alarmists are typically Westerners – academics, journalists, think tanks, and of course bureaucrats and central bankers. Like the internet, Bitcoin and crypto are highly diverse, agnostic, global systems for anyone and everyone, that will continue to grow.

In the West, we don't understand true currency debasement firsthand yet and perhaps that reality won't apply for many years to come. In its current state, Bitcoin in the West is more of an investment and a possible hedge against central bank overreach, impending socialism/MMT, and more importantly, it is an optimistic bet towards a decentralized, digital economy. Moreover, one could argue that inflation has been represented in asset prices for a number of years and the CPI is a poor measure of inflation, especially in an era of unprecedented monetary policy and printing. In hindsight, from a macro perspective we believe Bitcoin will have looked like an obvious buy when inflation becomes a reality, but it will be long priced-in by then.

Bitcoin is already "freedom money" for many around the world in places like Cuba, Nigeria, China, Pakistan, Venezuela, Russia, Turkey, Argentina, Palestine, Zimbabwe, and it's helping people escape tyranny and currency collapse. This should address Bitcoin's utility – especially given we are still relatively early in its adoption and usage. Much more value and utility will be unlocked across Bitcoin and crypto, eventually for billions of people.

We believe all of this and more, easily justifies Bitcoin's energy consumption, especially with renewables and all other context factored in.

We specifically only talked about Bitcoin mining here because most other large crypto networks are eventually going to use Proof of Stake and will no longer be part of the energy discussion. Proof of Work mining criticisms will likely only fall on Bitcoin in the future, as ASIC mining continues to grow through creative, cost-effective, and clean approaches.

The good news is, Bitcoin mining pools continue to increase in the US and the broader West and move away from China over time. These are much cleaner energy grids and many of these strategies will use the flared methane strategy mentioned previously, along with renewable mining initiatives. The trend is clearly going in a cleaner direction and new initiatives will ensure that.

This debate will become increasingly important as it's likely that nation states will use the energy canard to perpetuate attacks on the network. It's unlikely to be successful but perhaps part of the game theory to make the Bitcoin network thrive even more is the top layer communication, education, and building out rational, public arguments to defend the network (on top of the technology and encryption itself). There's still a very 'human' problem to be solved here, especially when talking about governments, and that's why being armed with facts and reason is important for future policy.

Below are some quality, credible sources on this issue you certainly won't find in mainstream establishment media.