The Mirage of Decoupling

There seems to be a blind spot in the crypto space when it comes to reasoning behind price action. There are many recent claims that crypto is decoupling as its own basket or a gold-like hedge to economic risk, but the reality is it's still behaving like a risk asset in lockstep with technology stocks and major indexes. Being honest about this fact will help portfolio construction.

Many headlines like this have been written since the SVB bank failure and more recently the First Republic collapse. While it's true Bitcoin may have periods of rogue price action, the high correlation to risk assets (e.g. tech stocks) has remained firm for the last few years. We still believe crypto assets will be the fastest horse once risk-on fully returns, but not for the reasons being claimed by many.

A macro fund portfolio may contain a % of crypto assets as a risk-on barometer to capture beta/growth, but it is realistically not treated as a hedge. Even as a predominantly liquid fund with a strong crypto heritage (with venture tendencies), we never viewed our crypto investments as a hedge to economic risk. We have recently seen what happens to crypto in a risk-off environment when inflation was on the rise. Claims that USD-hyperinflation or any broad risk-off scenario is positive for crypto is quite absurd at this point (not to mention the existential risk that a hyperinflation event would cause for the USDT/USDC liquidity backbone).

/cloudfront-us-east-2.images.arcpublishing.com/reuters/3NBROJEDHJMWJKC22FARBJ34NA.jpg)

It's important to look at what technology stocks have done in parallel to recent banking events. They've outperformed the rest of the market, just as crypto has. There are a few reasons for this, the main being the market is likely beginning to price in the (near) top for interest rates and the subsequent cutting of rates in the coming quarters. Many in crypto seem to ignore this fact and stick to the narrative that crypto is becoming a hedge or replacement for banks or dollars. As much as we believe in crypto and the utility of having new financial rails and use-cases, this is just confirmation bias and cherry-picking.

Dollar inflation also continues to come down and according to real-time data from Truflation, is now <4%. These are the real reasons for the latest price action. Not Balaji's "impending hyperinflation" or "USD collapse" claims, not a hedge to banking risk, and not a replacement for the current system.

(We also covered some of this in our last quarterly update)

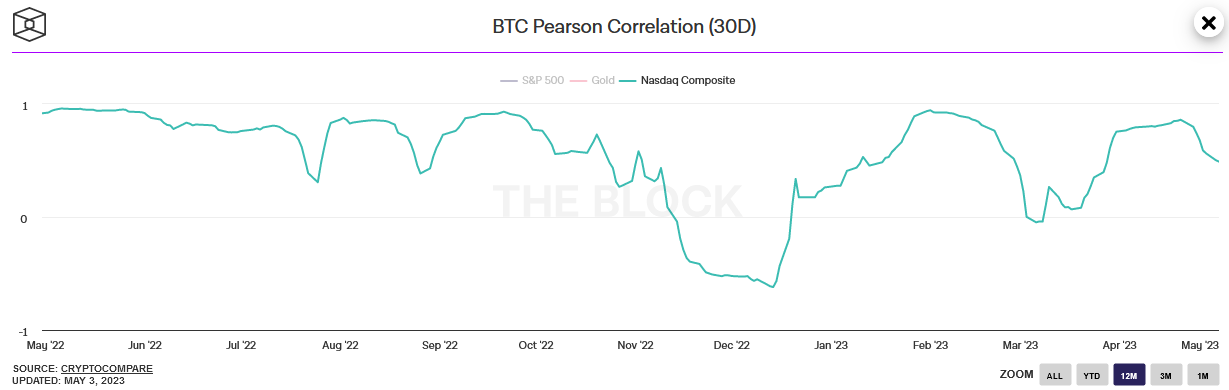

The above chart is the reality of Bitcoin and S&P correlation over the last ~4 years. There is no decoupling as seen, outside of rallies and crashes being more pronounced in crypto on shorter timeframes. The weekend price action, 24 hour trading capability, and relative lower liquidity of crypto results in quicker reactions and unique oscillations and behaviors. More importantly, these decoupling moments end up reverting back to the average correlation (~0.7-0.8) when volatility stabilizes.

Bitcoin and NASDAQ also hit strong correlation levels in 2023 and we believe it's a better representation, given it's the higher tech-weighted index. You can see shorter periods of lower correlation where either short term rallies or selloffs occur. This is again because of volatility. Short term instances of decoupling seem to be purely volatility-based to the upside or downside. Data from Macroaxis shows within a 90 day trading horizon, Bitcoin can be expected to generate 3.2 times more return on investment than NASDAQ. However, Bitcoin happens to be 3.2 times more volatile than NASDAQ. It's no wonder why accumulating and holding through the noise is still undoubtedly the best strategy for Bitcoin, assuming you believe in the asset long term.

All of this is not to say correlation couldn't decrease on a longer scale. There was once a time when crypto had low correlation, before ~2019 or so when the asset class was largely underground, far less liquid, and less talked about (those were the days!) But perhaps the irony is that as crypto becomes more "mainstream", amplified on social, and exists on more media shows and CNBC tickers, correlation may remain high. It's also possible that if crypto reaches peak adoption and has deeper liquidity, it can stand on its own and correlation could decrease again. We are leaning towards the former for the foreseeable future, but are certainly open for debate in the long run (and would prefer crypto to mature and stand on its own).

As mentioned, we still believe crypto will be the fastest horse as risk comes back into the market, which we've already begun to see proof of. It's also true that crypto is still nascent in not only the broader financial world (e.g. payments) but also on the side of daily user adoption. There have been many hurdles on both sides. Sometimes we ponder if this space was always meant to thrive as an underground, dissident, speculative retail-driven phenomenon and not try to jump on the stage as something more than it really is. That has happened to a degree in this space and we think it's important to be honest about that, particularly as AI use-cases emerge rapidly. Participants in the space also unknowingly still rely on the existing system and its stability more than they'd like to believe. These different worlds are not yet compartmentalized, even if a mirage is telling you so.

However, we still believe crypto can be legitimized as an institutional asset, improve many aspects of the existing system, and yes eventually replace aspects. This is what we are betting on, despite in many ways there being more noise than ever in the space between various macro narratives, regulation, and meme coins. Not deconstructionism and doomsdayism built on ignorance of how the current system operates. Real solutions and utility – and we will remain as objective as possible along the way.

This Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Visary Capital or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.