Fund Update – Q1 2022

Below are Visary Capital's venture investment and crypto updates for Q1 2022, along with our market outlook and analysis.

Previous quarterly updates:

Venture Fund Q4 2021

Crypto Fund Q4 2021

Note: For the calendar year of 2022, we will be combining our quarterly fund updates for both the venture and crypto funds into one post.

Q1 2022 Venture Investments

Our allocations for the venture fund are consistently growing with the performance of the fund. We did four deals this quarter and are focusing more on ownership and advisory. You can also read our market outlook for both venture and crypto below.

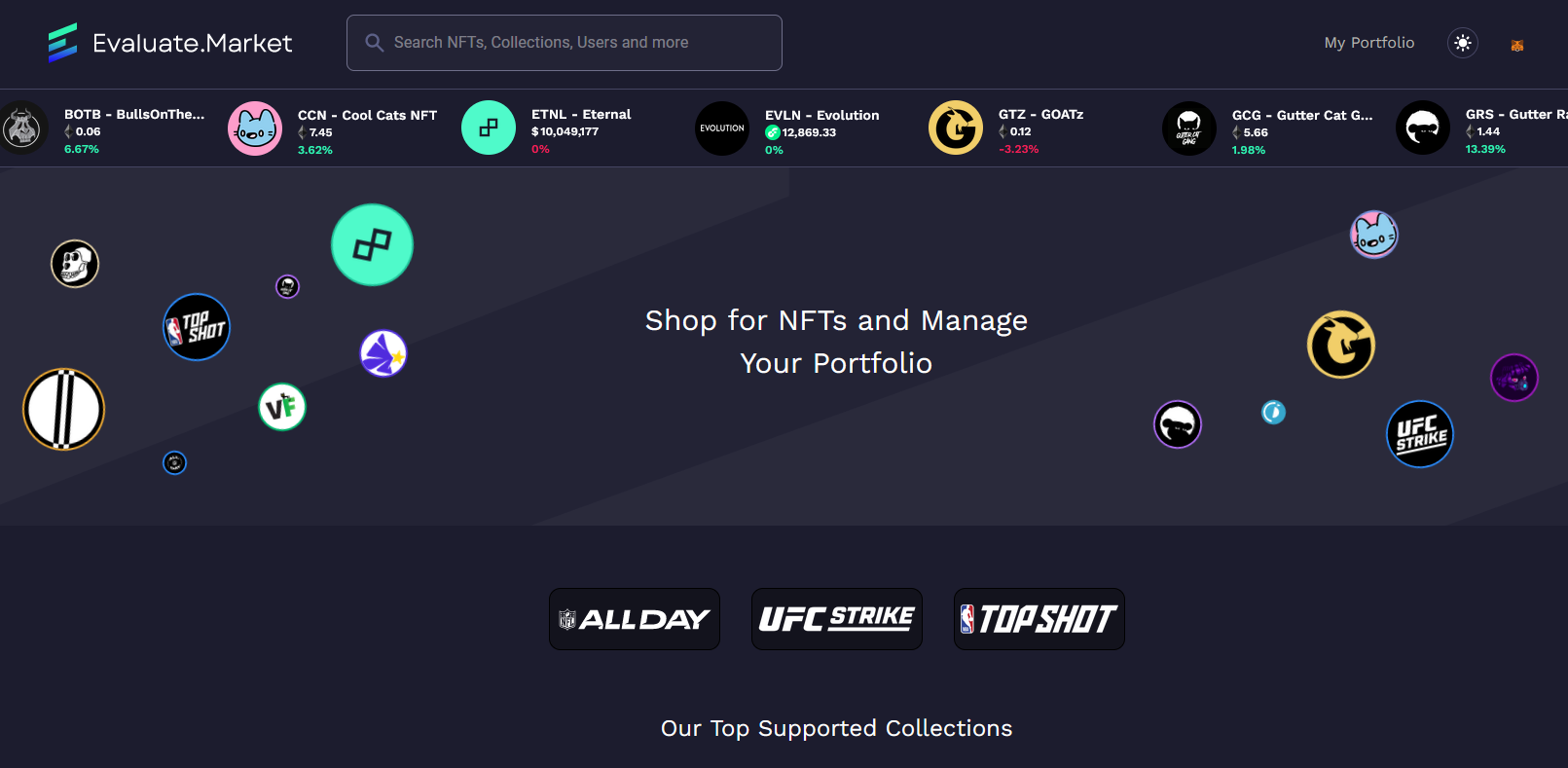

Evaluate Market (Seed, New)

We were excited to join Evaluate Market's seed round alongside some excellent funds. Evaluate wants to bring more of a social angle to NFTs without relying on Discord, along with providing the best real-time analytics on all the top projects. They earned their stripes (and already big user base) by being the first and best hub for NBA TopShot players. They are now moving into other sports NFT projects, partner closely with Dapper/Flow, and are expanding across multiple chains.

The team is highly data-driven and comes from the business intelligence space, so their understanding of analytics, visualization, and UX are some of the best we've seen in crypto. Once the social and aggregator areas are built out, we can see Evaluate becoming the #1 NFT analytics platform.

Koji (Series B, New)

Koji is a killer app for the rapidly growing Link-in-Bio genre. We describe it as Linktree on steroids, with a much bigger focus on creator monetization, crypto, apps and developer tools. The CTO of Koji is one of the best engineering minds we've seen, and anyone following them on social sees they ship constantly.

The bigger vision, which we can't delve into too much, is around integrating deeper with crypto, metaverse, and blockchain apps. They just added their own Bitcoin wallet and much more. I created my Koji here, you can check it out for an example: https://koji.to/fkhan

Jump Capital led this round, with some great investors and influencers on board.

Rarify (Series A, New)

Rarify is a unique NFT middleware play, with an incredible team based in Ukraine and NYC. We invested alongside Pantera Capital, Greycroft, Hyper, Eniac Ventures, Slow, and more. The team at Rarify will be building crypto-native use-cases for NFTs (e.g. lending) and on a bigger scale, are also close with enterprise customers like Shutterstock and Etsy that want to get into the NFT space. However, it is costly and challenging for these enterprises to build their own marketplaces and offer NFTs for customers.

There is no API standard or platform to allow Fortune 500+ companies to integrate with NFTs, and do so in a scalable way that extends it to all types of users. Oftentimes, crypto-natives get caught up in already knowing how to use web3, without realizing most of the world still doesn't understand the first thing about it. Rarify wants to lower this threshold and create simple, Stripe-like APIs that allow any company to setup an NFT offering and marketplace, on any chain, with any payment method.

Stakes (Seed, New)

In many ways, sports NFTs are an unsung hero of the NFT space and one of the biggest potenital areas of growth. The sports industry has massive synergy with crypto and this is why FTX and Crypto.com spend big bucks advertising in this area. We've looked at half a dozen sports betting / crypto crossover apps over the years and never found one that resonated. The approach Stakes is taking is novel, with an excellent team behind it.

Stakes wants to make sports wagering more social and allow people to collect NFTs based on their track record – in what they call "proof of flex." It's a perfect use-case for both social and crypto. They are hooking sports fans and the betting community through a beautiful app that makes betting casual, social, and fun. This will become the medium to implement deeper crypto-native functionality, with the goal to make it as simple and seamless as 'web2'.

We invested alongside Digital Currency Group, FBG, Sterling Select, CMS, and more.

Venture and Macro Outlook

Something unique about our fund is our experience in macro and public equities. We are always looking at and researching trends within technology sectors, but also on macro trends, which aids in our overall thesis of where things are going. The macro situation since COVID and over the past few months has been wild to say the least. It has ended up putting economies around the world into a tough position and coupled with the Ukraine/Russia situation, all existing issues will be potentiated.

You can argue the merit of COVID lockdown policies and their effectiveness, but it's clear that second order effects from them are now catching up. It put a wrench in the natural supply/demand cycle. It was also a catalyst for obscene amounts of money printing and stimulus policies, that ended up throwing gas on this fire even more. This has created very high inflation that we were told in the beginning was just "transitory." This has gotten governments around the world in a bind, with potential shortages looming in various regions and sectors. These second order effects are probably only 40-50% played out, there are more backlog effects yet to come (e.g. US dollar decoupling, along with a broad expectation and acceptance of governments centrally planning markets and resources, which has major ramifications moving forward). The "government knows best" mantra is now in full force, with the general populace and market drunk and dependent on government spending.

The dilemma now becomes whether to raise rates to slow down inflation, which would likely contribute to a price correction in equities and assets, or let inflation run and be strangled by increasingly bad CPI numbers. Both scenarios come with their own pain, and it's nearly impossible to rid both of these problems at the same time. The problem with option 1 is also when valuations get beaten up, hiring decreases, and layoffs are more likely. The problem with option 2, is that inflation destroys the middle class and people who need purchasing power the most. So both scenarios come with short term pain – pick your poison. Keep in mind, all of this is in parallel to growth slowing.

As mentioned in our previous update, we believe venture capital and private equity are going to see substantial devaluation by mid 2022, which is already in process. We have been more valuation sensitive the past 6+ months. Founders are beginning to become cognizant of this and offer better terms, although there is still a big chunk of FOMO deals left in the pipeline (especially in crypto). But private markets always lag publics – and while late-stage/pre-IPO deals have already seen lower mark-ups and even down-rounds, early stage investments haven't seen much of a change. We expect that to come in Q2/Q3. However, good teams and Founders will likely be able to still raise at higher valuations, with the variance in valuation widening between top notch vs average teams. We saw "average" teams raise at very high valuations over the last year+ and that is already starting to change. As derisking occurs, the bar for quality and due diligence finally rises again, and the rush for superficial markups decreases. Funny how that works, isn't it? In venture, we believe standards for Founder strength and archetype should always be consistent and think we've lived up to that.

Given technology's secular trend, this isn't of any long term concern, and it's quite possible technology and growth still perform relatively well in a recession period. Yes, I used the "R" word, and as of writing this, politicians and the media have been afraid to use the word (they will in the near future, although for now, we are hearing goofy euphemisms like "slowflation"). But initially, it is likely that valuations and follow-ons take a hit – and a good position to be in this scenario, despite inflation, is to have strong dry powder reserves to buy on fundamentals. Capturing fundamentally undervalued asset valuations outweighs any near-term purchasing power loss in dollar holdings. You can easily make up this variance with well-placed bets.

We don't believe a full mean reversion correction is necessary to get valuations to where they are "fair" (whatever that means) and it certainly also depends on macro and geopolitical factors. But markets are more often than not fractal, whether we want to believe that in the moment or not. Human nature tends to play out similarly, it's just a difference of how the end point is reached and what path is taken. Down rounds are already occurring, and most 2020-21 SPACs are well underwater from listing price (and even from earlier private equity rounds). The big question becomes how public equities hold up from here, and macro and monetary policy are the main indicators to determine that.

Q1 2022 Crypto Update and Outlook

Similar to the venture update, we mentioned in our previous quarterly update that we expected further downside in the crypto markets. In 2021, we told ourselves as things went parabolic and euphoric that no matter what, rotating certain positions consistently into USD/stablecoins (and BTC) to derisk and recalibrate had to occur throughout the clear euphoria stages. We sold a substantial amount of non-core crypto assets in Q4 2021, and throughout the year, which has allowed us to face any further downturn with much better leverage. All of our selling and rotations have been fully validated by deeper altcoin corrections we were able to avoid.

Q1 2022 was generally a quiet quarter for the crypto fund. Our main focus for the last 3-6 months has been increasing our BTC foundation–which in crypto terms is a relative way to derisk, while corrections are much sharper across low-float assets. Our cash position is strong for the fund because we delivered throughout 2021 and stacked dry powder for new opportunities. This was a contrarian position to have last year and before the downturn, and many wish they had rebalanced more proactively. Our portfolio is simple and concentrated right now, and our other big focus is investing in high quality SAFTs/warrants to support the next wave of entrepreneurs and crypto projects. The BTC+SAFT strategy gives us a better balance of liquidity and optionality through BTC, and discounted venture-type token investments. In crypto, there are always opportunities, and having a cash position can greatly help capitalize on this – particularly when further downside is plausible.

As for Ethereum, our other major core position, as exciting as the merge is, we are skeptical it will cause some kind of broader price decoupling from the market. It might outperform in some small, daily time periods towards the merge date, but not by much if the rest of crypto is being pulled down by equities and macro issues. However, if equities rebound, Ethereum should outperform substantially. Again, so much of this hinges on how 'traditional' markets perform. Regardless, it's still a relatively good long term bet at these levels, and as it transitions to the #1 staking network with positioning as a 'global bond', it's definitely going to be a huge feat for the community and will be amazing to witness as an Ethereum holder since early 2016. On a longer timeline, we have some contrarian views on proof of stake protocols relative to most of crypto, but we'll save that for another post.

Also, relative to most of the loud permabull participants on crypto twitter, we've been quite bearish (in the short/mid term) since November/December last year. Not for any fundamental reason in particular – the crypto narrative of censorship-resistance and decentralization is as strong as ever as we saw in the Ukraine situation, along with the Canada protests. Awareness and adoption of the asset class continues to rise steadily. But we must ask, where is net new billions of demand going to come from in 2022? We also must remember the sheer amount of euphoria experienced over the bull run, and ask how there would be another leg up of that euphoria, or if it needs to be balanced out by a greater level of panic–or if that is already priced in. We generally don't think it is. The macro situation is also unavoidable when discussing crypto trajectory in the near term.

It is borderline delusional to believe that crypto has at all "decoupled" from equities. Correlation between S&P / Nasdaq and crypto are at ~18 month highs and have been heavily correlated for longer than that. It is quite obvious that in the near term, crypto's fate is dependent upon equities performance. Anyone in crypto denying this, is denying reality. A decoupling event could eventually happen when crypto's liquidity is deep enough, but for now it is obviously a risk-on technology asset. This doesn't change our bullishness on it, we believe technology investing is still the best possible secular and exponential trend to be a part of. Crypto will be the fastest horse in the race, but it is still part of the same race, whether people want to admit that or not.

Final Thoughts

With all that said, we remain optimistic on our long term thesis. While any greater downturn could get ugly, it will be temporary, and offer new generational opportunities to invest in builders. It will also be the best possible thing for founders and builders to not be concerned with daily price movements and all the entitlement that comes with a bull market. All the best development last cycle occurred in the depths of the bear market, when hype had faded.

Lastly, even in a stagflation or recession environment, we believe in short order there will be a strong bid for tech stocks and crypto assets. Institutions are already here and will continue to look for the fastest horse if valuations pull back further and risk inverts again. There still has not been a full doom and gloom moment and we believe that has to happen before that bid comes back on full force. However, we do give the probability of the bottom already being in around ~35%. It's plausible that enough fear has occurred and that the Fed (and governments around the world) will once again turn on the spending engines in time to support prices, especially if the "R" word starts to come up. The first assets to benefit will be risk-on and technology. But it's still hard to shake the trilemma of inflation, growth slowing, and rate hikes.

In a way, we are happy to be proven wrong on some of our more bearish outlooks, because we are still positioned well in growth if the uptrend continues and are ready to fully re-deploy when certain signals and momentum returns.

Until then, we'll still be doing what we do best: Hunting the best Founders out there, and strategically adding to our core crypto positions.

This Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained on our Site constitutes a solicitation, recommendation, endorsement, or offer by Visary Capital or any third party service provider to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.